Anjouan Gaming (AOFA)

The Anjouan Gambling License, issued by Anjouan Gaming, offers a streamlined and cost-effective regulatory framework for online gaming operators. Anjouan, an autonomous island within the Union of the Comoros, has become a preferred jurisdiction for iGaming businesses due to its favorable tax policies, efficient licensing process, and broad market access.

License Checking- How to Verify

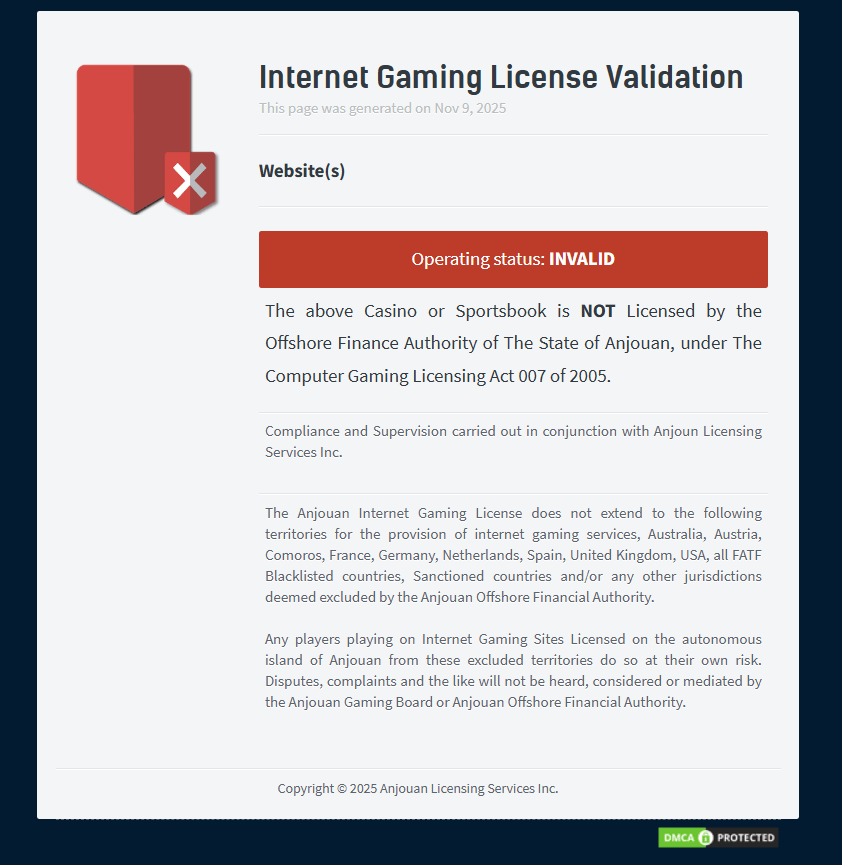

If you want to make sure a casino is really allowed to operate, there are two easy ways to check.

First, many casinos with an Anjouan Gaming license have a little badge or logo on their website. You can usually find it at the bottom of the page. If you click on it, it will take you to a page that shows important info like the casino’s name, address, email, and all the websites it owns.

This page also tells you if the casino is actually allowed to run, and it should say VALID. One thing to watch for is the website address—it should start with “https://verification.anjouangamingboard.org/validate?domain=“. That way you know the page is real.

Some casinos don’t have this badge on their site. Don’t worry—you can still check by visiting the Anjouan Gaming website and looking at the Licensee Register. This list shows all the casinos with a license and even tells you when their license expires.

How to obtain Anjouan Gaming (AOFA)

To obtain an Anjouan gambling license, operators must:

-

Establish an International Business Company (IBC): Incorporated under Anjouan law, with no requirement for local shareholders or directors.

-

Submit Documentation: Including company registration documents, passports of directors and shareholders, financial statements, and proof of domain ownership.

-

Demonstrate Compliance: Provide policies for Anti-Money Laundering (AML), Know Your Customer (KYC), and responsible gaming, along with technical infrastructure details.

-

Undergo Due Diligence: The application process typically takes 1–2 months, depending on the completeness of the submission

Fee and requirement

Initial Application Fee: Approximately €17,000, covering due diligence and compliance fees.

Annual Renewal Fee: Around €13,300, including a compliance officer fee.

Taxation: There is no corporate income tax or gross gaming revenue (GGR) tax on offshore income for International Business Companies (IBCs).

Capital Requirements: No minimum paid-up capital is mandated, though demonstrating financial stability is advisable

Markets Across the World

Anjouan-licensed operators can legally target markets in Africa, Asia, and Latin America. However, they must geo-block access from certain jurisdictions, including:

United States

United Kingdom

Germany

France

Spain

Australia

Austria

Comoros itself

This geo-blocking is essential to maintain compliance with licensing terms